Factor 1: ISM Manufacturing PMI

The US ISM purchasing managers’ Index continued to stay below the benchmark of 50, suggesting contracting activities coming from the manufacturing sector. Looking into the employment level also slipped, showing further weakness in labor market conditions despite the slower increase in pricing level.

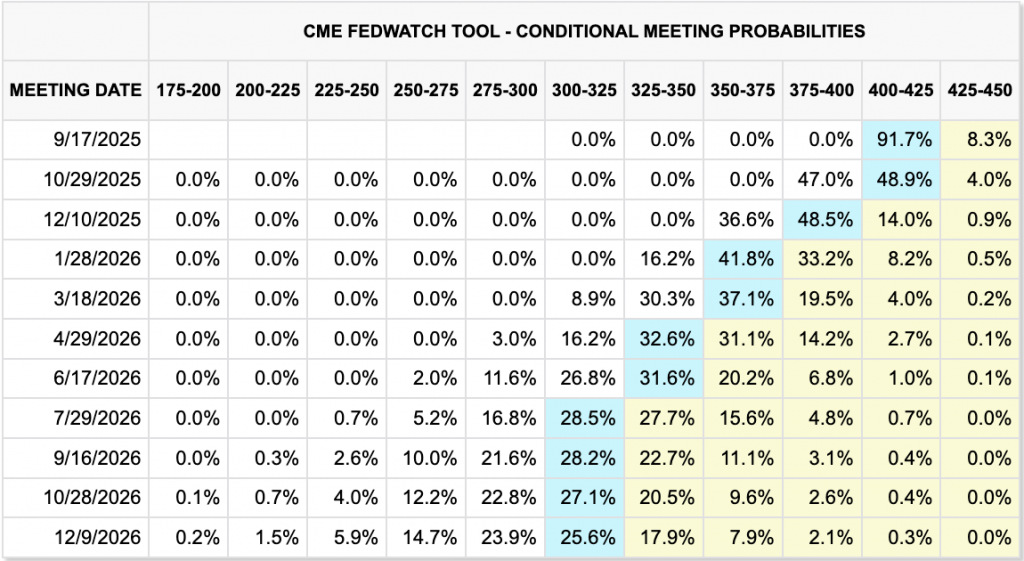

Therefore, the market re-priced on a higher rate cut projection, which has surged to over 90%, higher than the previous forecast yesterday.

All of these are signaling a less optimistic outlook for the US economy, which is weakening the USD and supporting gold prices.

Factor 2: Tariff Uncertainty

President Donald Trump plans to appeal to the Supreme Court to quickly reverse a federal appeals court ruling that declared many of his tariffs illegal. Trump insists these tariffs are vital for his trade policy and warns that overturning them could devastate the U.S. economy. The tariffs remain in place until mid-October, pending the appeal. However, Trump also reported that this relief appeal will come as soon as Wednesday.

→ If the US court believes that Trump should refund the previously collected tariff → major blow US treasury and market.

→ Uncertainty in Tariffs leads to appreciation of safe-haven assets such as GOLD.

Factor 3: Geopolitical Tension

Russia-Ukraine development: Russian drones continued to attack in Ukraine’s Dnipropetrovsk region, which is further accelerating uncertainty in the market.

US-Venezuela: President Donald Trump announced that U.S. forces had conducted a “kinetic strike” against a drug-carrying boat in international waters. This marked the start of another war, which the US has fought against Venezuela, claiming that the illegal drug has been pushed into the US and other nations. Furthermore, there are expected to be more US warships, along with one nuclear-powered fast attack submarine, to be there soon. Although Venezuela has not responded yet, Mr. Maduro also threatened an “armed fight” in response to any military action.

Potential market reaction

—>this is another tension on war conflict, which could potentially push the gold price higher.

All of these factors, such as dovish FED expectations on rate cut, uncertainty in tariffs legal act, and higher geopolitical tensions are contributed to rising gold prices yesterday and will potentially lead to more increases if tensions still exist. But do remember, if tension is too much, gold slip is also likely, just like what we experienced last time—aka over fear pulls the investor out of the market.