Federal Reserve Rate Cut Potential

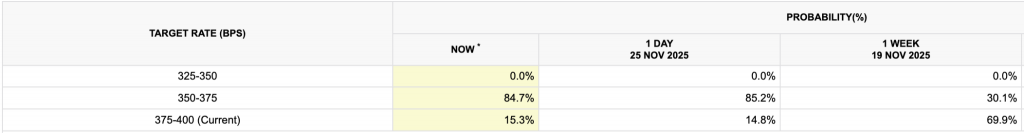

We are now witnessing above 80% bet on a December Fed rate cut bet once again, higher than the previous week at 30.1%, given how the leading candidate for the next Federal Reserve Chair is now likely to be Kevin Hassett. A little background, Kevin Hassett is now leaning toward easing the monetary policy, supporting Trump’s long-standing wish. So, having him as a frontrunner, the rate cut bet would also increase. Even JPMorgan also projects to see two more rate cuts in December and January with 25bps cuts each, according to the Bloomberg source.

Lower rate cut → weakening the USD and boosting gold prices.

Geopolitical Tension

Meanwhile, the report also covered the uncertainty in geopolitical tensions, which is giving a heads-up for the market to price in gold as a safe haven asset since the early part of the week. Although the White House insisted on security guarantees for any final peace plan, the market is currently still doubting reaching the deal any time soon. Especially when Bloomberg reports released an $8.2 billion IMF deal with Ukraine earlier, aiming to relieve some challenges amid this prolonged war conflict, while Russia’s Ryabkov also raised some doubts that Ukraine has been receiving U.S.-made weapons and intelligence despite an improvement. Furthermore, Kremlin spokesman Dmitry Peskov also cited on Wednesday that “the negotiations were ongoing and the process is serious.”

Looking forward to the US Envoy Witoff meeting in Moscow next week to further discuss the peace plan.

Just remember

More tension → push gold higher

But if the peace plan proceeds well → gold can dip again.