Ever Since the clash between Political and Federal reserve conflict happened, the macro narratives are getting noisier. Trump publicly argued the inflation print justifies rate cut, while the report also describes the administration’s escalation pressure on Chair Powell, including the Justice Department Probe and grand Jury Subpoenas tied to the Fed Building Renovation, suggesting this is the part of broader pressure on Fed’s policy independence.

Data released on Yesterday US Inflation view was mixed but its cooling underneath the Core CPI rose from 0.2% Versus the 0,3% forecast and previous data 0.2%, while Headline CPI held at 0.3% m/m and 2.7%y/y Steady but not re accelerating.

For gold, the CPI mix is still typically supportive because the downside Surprise in core tends to pull down rate expectations and rate yield which USD tends to soften alongside. Combining this with the Fed conflict/Subpoena backdrop can also add the second factor which policy uncertainty can raise demand for gold as a hedge.

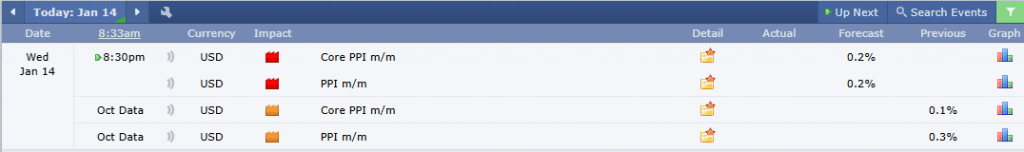

That’s why today what to look for is the next big confirmation which is PPI/Core PPI (along with the backflip Oct Data) due Jan 14 at 8:30am ET or 8:30pm GMT+7. The Hot print could reprice Yields up and pressure gold in the bearish trend, while A soft print would indicate the CPI “cooling” signal and like keep gold direction in bullish trend.

Just remember:

- If Core PPI Comes in Soft → Reinforce Cooling inflation → More supportive for gold.

- If Core PPI Comes in Hot → Reinforce Heating Inflation → Gold Pressured/Possible reversal.