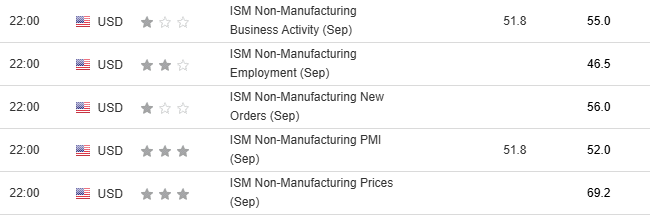

Despite an uncertainty in NFP payroll data time release, another data to look forward to tonight is the ISM non-manufacturing PMI at 10:00 PM.

Projected: 51.8, down from the previous figure of 52

However, this forecast remains above the benchmark of 50, showing a continuous expansion in the service sector, while previous pricing should be a concern. This should be a good sign for the US economy.

- If this comes higher or above 50, especially if pricing shows a more persistent inflation, the odds of a rate cut reduce, and it is likely to put downward pressure on the gold price in the short term.

- If not—below the 50 and pricing drop—> the rate cut bet will be higher, and the gold price is likely to be in favor.

***But that is not always the case. So read the report for more insights and more accuracy on the service business performance.

Regardless, once again, the nonfarm payroll tonight is still uncertain with regard to the timing of release; therefore, be sure to watch out tonight. Read more insight from our previous article today.

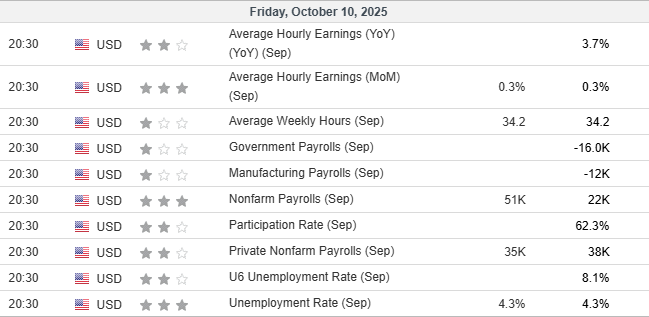

In case they release Nonfarm Payroll data tonight:

Expectation:

These data indicate a stronger labor market as both private and government employee is expected to rise to 51K combined, up from 22K, while other data, such as unemployment rate and average hourly earnings, are both projected to an unchanged.

- Stronger printed that suggests having stronger labor market conditions –> gold price will likely decline.

- Weaker printed that reflects on softening labor market conditions –> gold price will be in favor.