The U.S. labor market continued to show signs of weakness, with ADP reporting lower employment, Challenger cut indicating more job cuts, JOLTS showing fewer openings, and rising jobless claims. High productivity eases inflation but reduces hiring demand, leaving the labor market fragile.

In fact, the Federal Reserve Governor Christopher Waller also noted “a continued deterioration” in the labor market conditions that could signal on having an early easing to combat this softness. As for the Federal Reserve, President John Williams raised concerns, highlighting challenges from shifts in immigrant labor and expecting the unemployment rate to rise to about 4.5% next year. He projects PCE inflation at 3.00%-3.25% this year, cooling to 2.5% by 2026. He also notes that tariffs are already impacting prices and consumer behavior, though they have not yet triggered a long-term inflation spike.

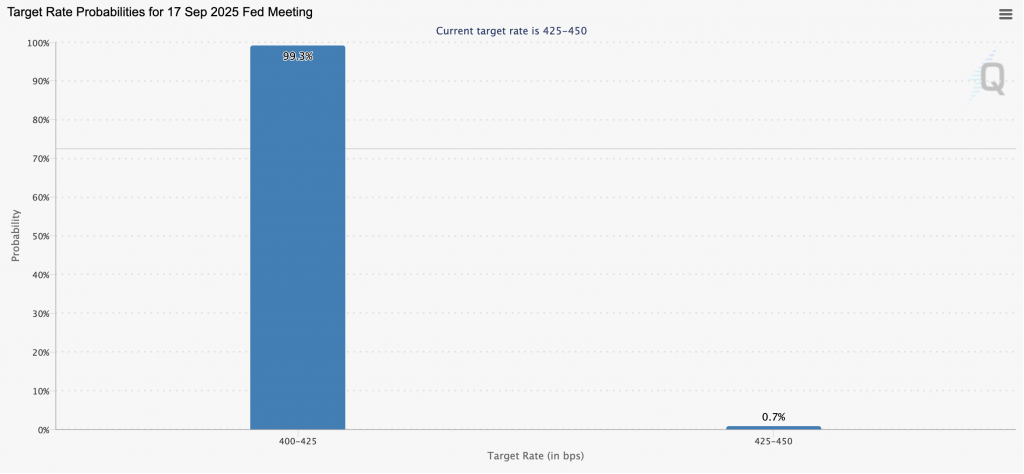

Markets now see a 99.3% chance of a Fed rate cut, as weak jobs and high productivity lower inflation risks, which give the Fed room to ease monetary policy. In a very simple meaning, the cracks are forming.

So if tonight’s payroll miss, or wage growth cools further, while increasing the unemployment rate, then the FED’s path to cut the rate will get even clearer. However, if the data becomes stronger, then the market may need to rethink its economic stance again.

US-Japan 15%

According to Reuters, President Donald Trump signed an executive order on Thursday formalizing a U.S.-Japan trade agreement, implementing a 15% tariff on most Japanese imports, with special rules for cars, aerospace, generic drugs, and scarce natural resources. The lower tariffs on Japanese autos are set to take effect seven days after publication of the order.

Other than this, Trump is still urging Europe to pressure China over Russia’s war, while China’s Xi reaffirms ties with North Korea. All of these are causing some certainty in the market; however, the recent gold price has not reacted fully yet, as the market is still waiting for tonight’s nonfarm payroll data.