Monthly Report in January, 2026

Executive Summary

This report provides an analysis of the primary factors influencing gold prices, offering insights for investors.

***All information presented is for educational purposes only and should not be interpreted as financial advice or a recommendation for trading or investment decisions.

Fundamental Analysis

Previous Recap of the Whole Economy: In January 2026, global financial markets began the year in an environment marked by moderate economic growth but elevated uncertainty. While most major economies have avoided a sharp slowdown, confidence has weakened due to persistent inflation concerns, political uncertainty, and ongoing geopolitical tensions.

In the United States, economic activity has remained relatively stable. Consumer spending continued to support growth, helped by a still-resilient labor market. However, inflation has not fully returned to the Federal Reserve’s target, especially in services, limiting the central bank’s ability to ease monetary policy. As a result, investors remain cautious and highly sensitive to economic data releases.

Financial markets reflected these concerns through rising long-term government bond yields. This increase was driven not by stronger growth expectations, but by worries over fiscal sustainability, trade policy uncertainty, and political risk. Similar pressures were observed in other major economies, reinforcing a global sense of caution.

China showed signs of gradual stabilization supported by policy measures, while Europe continued to face weaker growth conditions. Overall, the global economy remained steady but fragile.

Within this context, gold prices stayed well supported. Demand for gold was driven by uncertainty rather than economic optimism, as investors sought protection against inflation risks, geopolitical tensions, and policy instability. Despite higher bond yields, real interest rates remained constrained, allowing gold to maintain its strength throughout the month

Forward-Looking

As markets move further into 2026, several key factors will dominate gold price dynamics in the coming weeks and months.

U.S. Economy and Monetary Policy

Economic calendar-wise, what we should focus on are the Fed’s favorite inflation gauge, the PCE price index, along with the PPI data, all of which are shown on the inflation insights. Plus, with the labor data such as weekly initial jobless claims on the horizon before reaching the most looking-forward data this month, “THE FED FUND RATE”.

Here is two main scenarios dominate expectations:

- If both inflation and labor data soften, this would reinforce expectations of rate cuts later in the year. Such an outcome would likely push real yields lower and weaken the U.S. dollar, creating a supportive environment for gold.

- If labor conditions weaken while inflation remains persistent, the Fed may be forced into a restrictive holding pattern. This would introduce policy uncertainty and raise recession risks, a scenario that historically benefits gold despite short-term yield volatility.

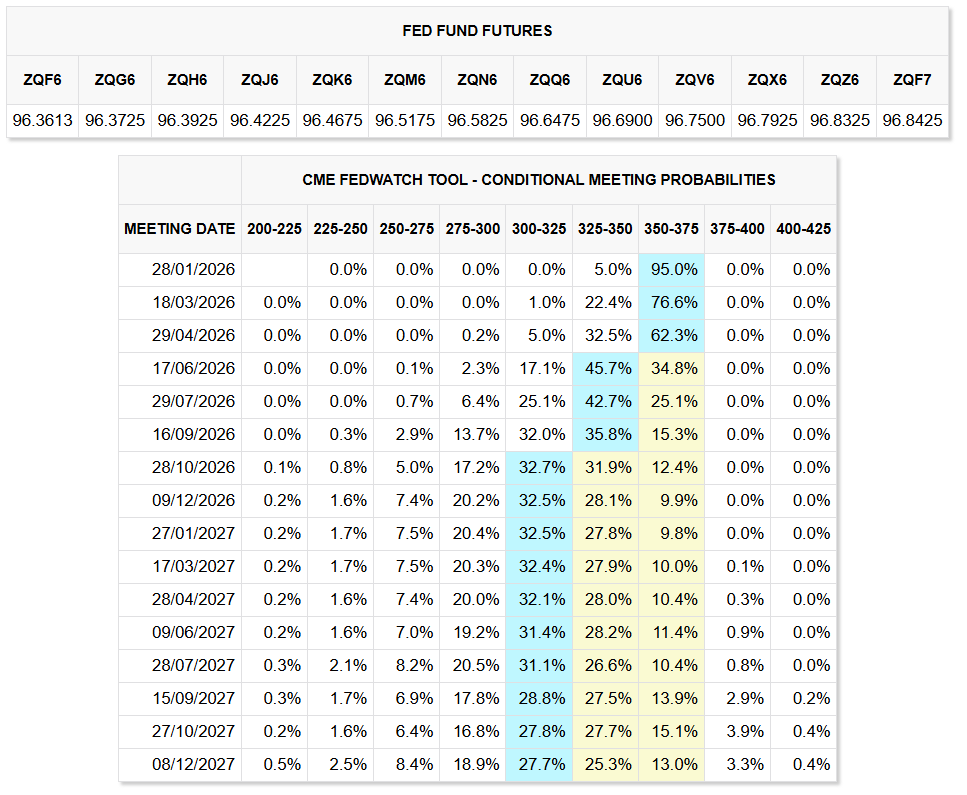

Federal Reserve communication, particularly speeches and meeting minutes, will be closely scrutinized for signs of concern about financial stability, political pressure, or long-term debt sustainability. The market is currently priced in 95% on rate holding this month until two rate cuts later this year, starting in June and October 2026.

Beyond the U.S., central bank decisions from Japan and Canada will also be important. Any indication of renewed stimulus—especially from Japan—could weaken global currencies against gold and further strengthen bullion demand.

Geopolitical Tensions

United States and Trade Policy

The uncertainty surrounding U.S. political leadership, fiscal discipline, and central bank independence has added an additional layer of risk premium to markets. For gold, this environment remains structurally bullish, as investors seek protection from policy unpredictability.

With these tariff threats against the nations we mentioned above, and combined with the attacks on its plan, plus Greenland’s threatening fear all over the topic, all of these are pushing the investor to seek a better and safer asset such as Gold, leading the gold prices to reach even higher recently.

Tariff’s threat against other nations as of Jan 20., according to the bloomberg.

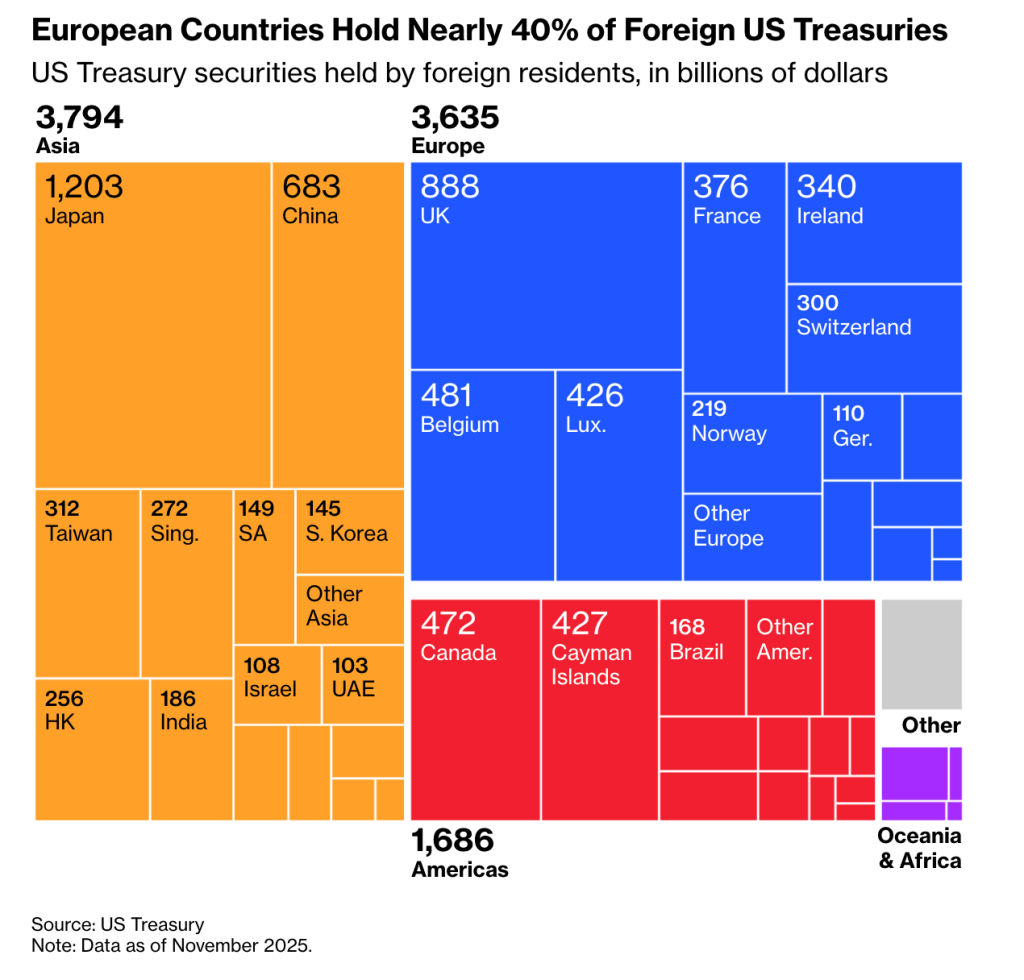

Especially when sell-offs on the foreign US treasuries topic are widely used to leverage their talk with Trump’s negotiation, having such a talk would only threaten the US strength, while pushing up the gold prices even further.

So here is a catch:

→ as long as the tension still exists in this talk, meaning Trump still threatens other nations or they favor selling off the US bond, the DXY or US currency strength will likely stay weak, as shown in the image. Unless the investor’s confidence comes back to restore the US strength.

Ongoing War Conflicts

Geopolitical tensions beyond trade continue to play a significant role:

- Russia–Ukraine conflict: Escalations persist, with continued strikes on energy and infrastructure assets. Diplomatic progress remains limited, keeping geopolitical risk elevated.

- Middle East tensions: While intermittent ceasefire discussions have reduced immediate escalation risks, the situation remains unresolved. Any breakdown in negotiations could quickly reignite safe-haven demand.

→ As long as major geopolitical conflicts remain unresolved, gold is likely to retain its role as a strategic hedge against global instability.

Gold Market Implications

From a broader perspective, January 2026 reinforces the narrative that gold is being supported by risk-driven dynamics rather than growth-driven optimism.

- Rising yields have not significantly pressured gold because they reflect fiscal and political concerns rather than economic strength.

- Inflation uncertainty keeps real yields constrained.

- Geopolitical and trade tensions continue to generate safe-haven inflows.

- Central bank caution limits the upside for the U.S. dollar, preventing sustained downside pressure on gold.

In the absence of a clear disinflationary breakthrough or a decisive geopolitical resolution, gold prices are likely to remain elevated, with volatility biased to the upside during periods of market stress.

Technical Analysis

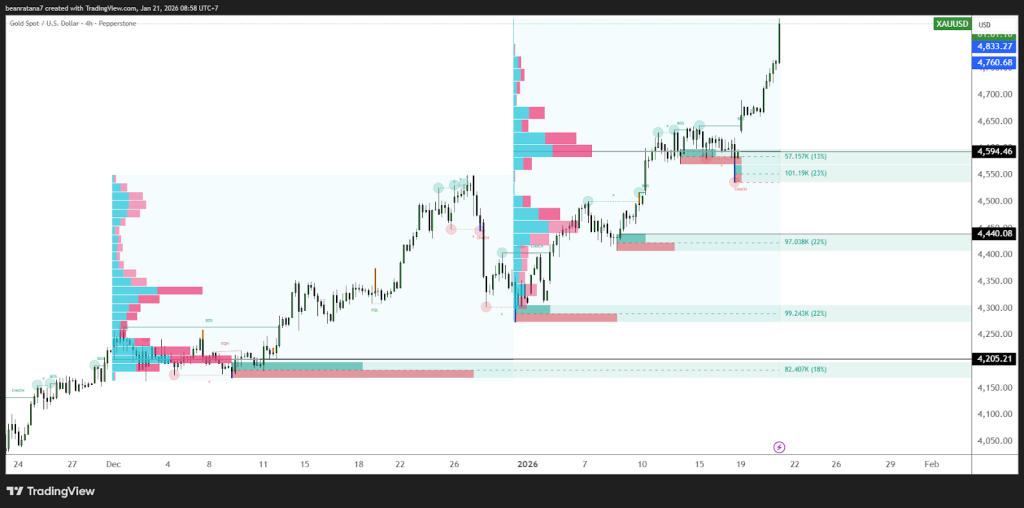

Gold Market Overview — January 2026

Gold is currently trading at $4828.57, continuing its bullish momentum amid the Geopolitical Tensions. The chart reveals a strong buying pressure late December 2025 after a pullback.

Key Technical Zones

- Current Price: $4828.57 — Trading above all major resistance zones with 3 weeks straight up.

- This Week Point of Control (POC) at $4594.46— Highest volume level this week, indicating where market participants found the most value to act as first support level.

- This Week Volume Cluster at $4440.08 — A high-volume “fair value” zone from last week, can act as a second support level.

- Last Week Point of Control (POC) at $4205,21 — Highest volume level from last week, indicating where market participants found the most value act as the third support level.

Trading Strategy

- Bullish Bias : Bullish Bias: The current trend remains bullish, having risen for 3 consecutive weeks in the new month. However, this rise could increase the chances of a short-term decline. Those looking for buying opportunities should look for pullbacks to capture good prices and narrow gaps.

- Pullback Scenario: In the current environment, while the market continues to trend higher, pullbacks remain possible. It is therefore essential to monitor real-time price action before entering any position, in order to avoid exposure to sharp retracements. Our focus remains on buying opportunities at key price areas, specifically the first, second, and third support levels, allowing for higher-quality entries with controlled risk.