Gold prices have finally reached above $4,000 per ounce, given how the US government shutdown has not been resolved ahead of the potential interest rate cut in late October.

Now let’s see some development:

US Government Shutdown.

Trump proceeded to put more pressure on the Democrats, saying that “some government workers furloughed during the shutdown could receive backpay, while others won’t.” according to the Hill report. The “others” here—the market viewed it as the Democratic parties, which they are unlikely to get paid for this shutdown. This is also seen as a scheme that Trump aims to stir up within the parties, while pressuring them to end this conflict as soon as possible.

Furthermore, Trump reiterated that he will comment about layoffs in the next 4-5 days—a few days after the potential of having nonfarm payroll data release (if the US shutdown is ended).

Opinion only:

But the tricky part here is that,

→ If Trump really plans to comment on the layoffs outlook, does he really expect the shutdown to continue? And does that also mean that nonfarm payroll data is also likely to be delayed? Or does he plan to release the data on the expected date, but the US shutdown remains unchanged?

Regardless, our scenario will likely stay the same:

As long as the US shutdown continues, which increases the risk of layoffs and economic fragility, an interest rate cut in October → gold price is likely to appreciate.

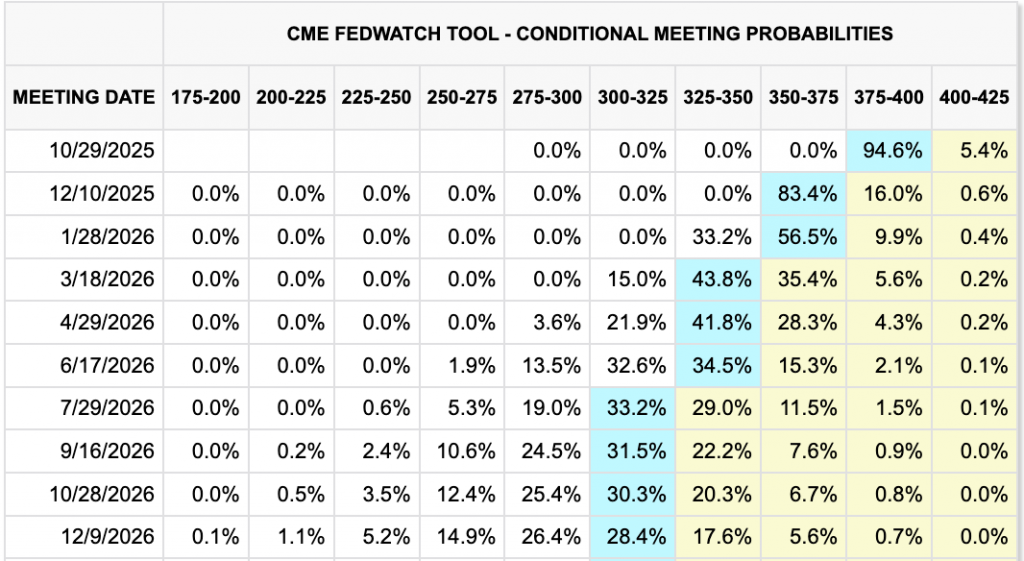

For now, there is a 94.6% odds of having the rate cut by 25 bps this month, while the odds of 83.4% will have another 25 bps rate cut before the year’s end. So what is being said here?

*** Uncertainty in the US economy + Rate cut projection → factor in pushing the gold price high and reach the $4,000 per ounce. ***

According to CBA forecasts, they expect to see gold prices increase to $4,500 per ounce by the second quarter in 2026, while emphasizing the difficulty in identifying any bearish drivers for now.

However, do note that bearish drivers could be the potential of a ceasefire from the Middle East, interest rate cut delay, or even a tariff agreement. Those are the things that could pull the gold price lower.

Other News: Trump’s Tariff on the Canadian Sector

President Trump expressed optimism about a potential US-Canada trade deal, but was unclear on specifics or timing. He noted a “natural conflict” due to competition for business, though progress has been made.

Canadian PM Mark Carney highlighted Canada’s significant investment in the US, suggesting it could grow with a favorable agreement. Trump emphasized the US’s market size advantage in their competitive auto industry.