Weekly Data Summary Report

As of March 15, 2024

In this report, we will assess major economies, including the United States, the Eurozone, Japan, and Canada, mainly based on their economic indicators and economic events that have occurred within this week.

Japan

Given how Japan’s economy expanded further along with an acceleration of inflation, there are some drawbacks that Japan may likely face in order to reach its target of 2% GDP by 2027. This comes when the US puts pressure on adding more spending on the defense “at least 3% of GDP” (currently at 1.4% of GDP) at a Senate confirmation hearing. This also means that the growth of Japan’s GDP would also force Japan to spend more on defense. Therefore, attention arises on whether this increase in defense spending would impact Japan’s finances, especially when they have already had a high debt level. Some speculations mentioned that more interest rate hikes will be likely, potentially strengthening the JPY against other currencies. As of now, overall wage income and household spending have dropped, in January, which also reflects a weakness in consumer sentiment ahead of global uncertainty.

Canada

The Bank of Canada’s move on the rate cut comes as the heat over the tariff war surged higher and recession risk rose. Although this adjustment only lessens the damage to the economy, the risk of slowing down or a possible recession is still very likely with a projection of inflation shock from the trade war. In fact, Trump is still committed to imposing his tariff deal with Canada and Mexico unless “drug flow stops.”

The European

A trade tension between the US and EU escalated when Trump imposed a 200% tariff on wine, champagne, and other alcoholic beverages from France and elsewhere in the European Union after the EU retaliatory tariff on US imported goods. Trump also added that “EU is treating the US very badly” and “They’re suing Google, they’re suing Facebook, they’re suing all of these companies, and they’re taking billions of dollars out of American companies,” hinting that this tension may take time to ease longer than we expected.

The United States

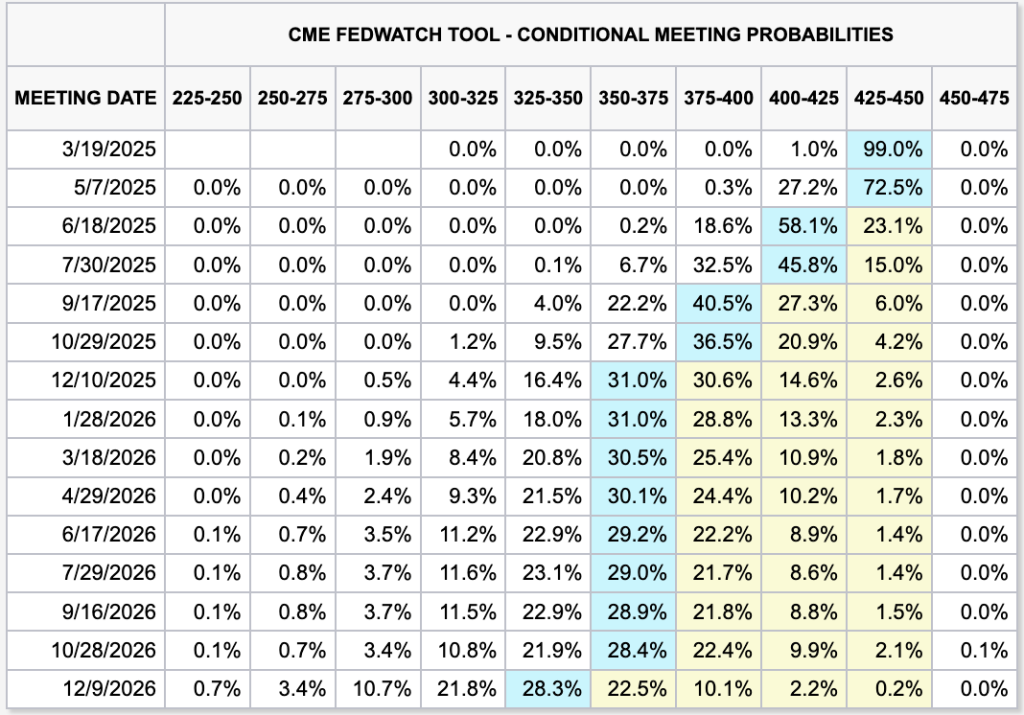

Despite US inflation easing for February, the market is still having a softer sentiment on the economic outlook while projecting higher inflation expectations. Even though this higher inflation anticipation could lead to a pause in the FED Fund rate, the CME FEDWatch tool told us otherwise, projecting to have 3 rate cuts this year. This also comes when the stock market has been significantly dropped, while gold has finally reached its peak at $3000 per ounce. All of these indicate that trade tension, fragile economic outlook, and uncertainty in geopolitical tensions are further raising the odds of recession risk.