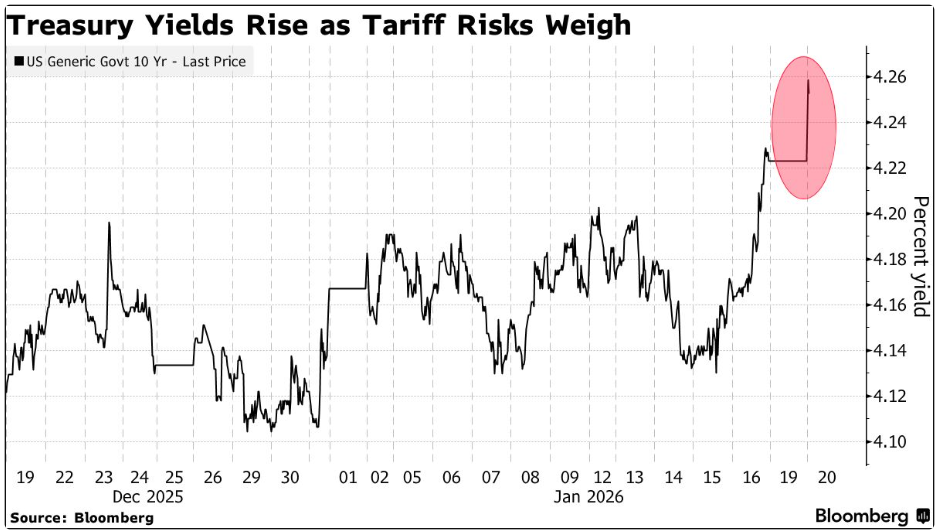

According to Bloomberg, “ Treasuries joined a selloff in global bonds as the threat of US tariffs relating to Greenland undermined demand for American assets and added to concerns about Washington’s long-term fiscal position”. The recent global bond selloff, led by US Treasuries, highlights rising investor concern over political and fiscal risks rather than improving economic fundamentals. Renewed US tariff threats linked to Greenland have revived fears of trade escalation, undermining confidence in American assets and raising uncertainty around long-term debt sustainability.

At the same time, questions over Federal Reserve independence and speculation about future leadership have added to risk premiums at the long end of yield curves. With the US heavily reliant on foreign capital, potential reductions in Treasury holdings by European and Japanese investors could push borrowing costs higher, tightening financial conditions and weighing on global growth. For the gold market, this environment remains supportive despite higher bond yields. The rise in yields is risk-driven, not growth-led, which limits upward pressure on real yields. As Treasuries lose some of their traditional safe-haven appeal, gold benefits as a neutral store of value free from political and credit risk.